-

contact@gprs.co.in

-

Mon - Fri: 9:30 AM - 5:30 PM

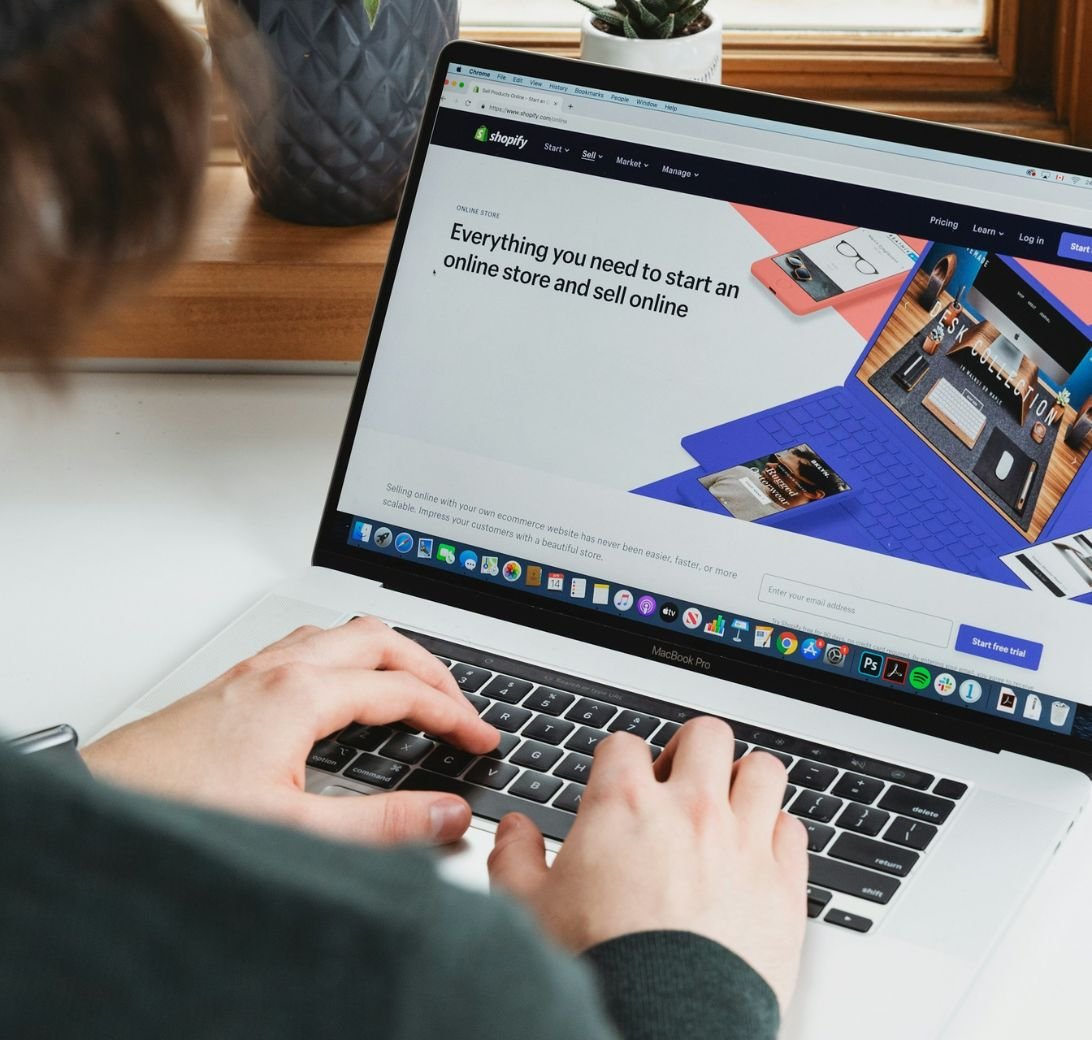

Incorporation services in India help legally establish businesses such as Private Limited Companies, Public Limited Companies, LLPs, and One Person Companies, each offering unique benefits.

Private Limited Companies are ideal for small to medium enterprises due to limited liability and separate legal status, protecting personal assets from business risks. Public Limited Companies allow larger businesses to raise capital from the public, offering flexibility in ownership transfer. LLPs are a hybrid of partnerships and corporations, offering limited liability with flexibility, making them suitable for professional services and smaller businesses. One Person Companies are designed for solo entrepreneurs, providing limited liability without the complexity of multiple shareholders.

These business structures provide liability protection, enhance business credibility, and improve access to capital, making them attractive choices for entrepreneurs and companies seeking long-term growth and sustainability in the Indian market.

We conduct a detailed assessment to align our services precisely with your unique requirements.

Research and analysis provide insights that facilitate informed decision-making and innovation.

Verify and confirm details to ensure accuracy and prevent miscommunication.

These services are typically outsourced to professional payroll service providers who specialize in handling the complexities of payroll calculations, tax withholdings, and compliance with payroll-related regulations.

These services are typically outsourced to professional payroll service providers who specialize in handling the complexities of payroll calculations, tax withholdings, and compliance with payroll-related regulations.

These services are typically outsourced to professional payroll service providers who specialize in handling the complexities of payroll calculations, tax withholdings, and compliance with payroll-related regulations.

4.9 Rating 1000+ Reviews

Years of experience

Happy Clients

Service Categories

Accounting services help businesses maintain accurate and reliable financial records, gain insights into their financial performance.

Taxation services aim to ensure compliance with tax regulations while minimizing tax liabilities and maximizing available tax benefits.

Taxation services aim to ensure compliance with tax regulations while minimizing tax liabilities and maximizing available tax benefits.

The service provider initiates the process by conducting an initial consultation with the client. This involves understanding the clients specific needs, financial situation, and goals.

Donec sem rhoncus feugiat arcu erat. Consectetur condimentum adipiscing nunc pellentesque eget eros.

Quisque at pellentesque quisque egestas. Nulla egestas est donec dolor lectus porta sed risus.

Donec sem rhoncus feugiat arcu erat. Consectetur condimentum adipiscing nunc pellentesque eget eros.

Quisque at pellentesque quisque egestas. Nulla egestas est donec dolor lectus porta sed risus.

Common structures include Sole Proprietorship, Partnership, Limited Liability Partnership (LLP), Private Limited Company, Public Limited Company, and One Person Company (OPC). Tax avoidance refers to using legal means to reduce your tax liability but in ways that are often not in the spirit of the law.

Post-incorporation, businesses must comply with annual filing requirements, maintain statutory registers, hold board meetings, and file income tax and GST returns as applicable.

Incorporation provides limited liability protection, separates personal and business assets, enhances credibility, allows easier access to funding, and offers tax advantages under certain structures.

Yes, you can operate a business from home as long as it complies with local zoning laws and regulations. Your home address can be used as the registered office address.

Yes, you can change the name of your company by following a formal process as per the Companies Act, 2013.

Yes, you can change various particulars of your company, such as the registered office, directors, share capital, company objectives, Memorandum of Association (MOA), Articles of Association (AOA), company type (e.g., from Private to Public), and ownership/shareholding pattern. Each type of change has a specific process, which usually involves board or special resolutions and filing the appropriate forms with the Registrar of Companies (RoC).

4.9 Rating 1000+ Reviews